Unlocking the Benefits of Your PF Account: When and How to Withdraw Funds

In India, individuals in the workforce typically have a Provident Fund (PF) account. Managed by the Employees' Provident Fund Organisation (EPFO), this service serves as a form of savings plan for the future. A portion of one's salary, usually 12%, is deposited into this account every month, with the government also providing interest on the deposit. However, it's essential to note that a PF account isn't just for future savings—it can also be accessed for financial needs as they arise. Let's explore the various occasions and the corresponding amounts that can be withdrawn from a PF account.

Medical Emergencies:

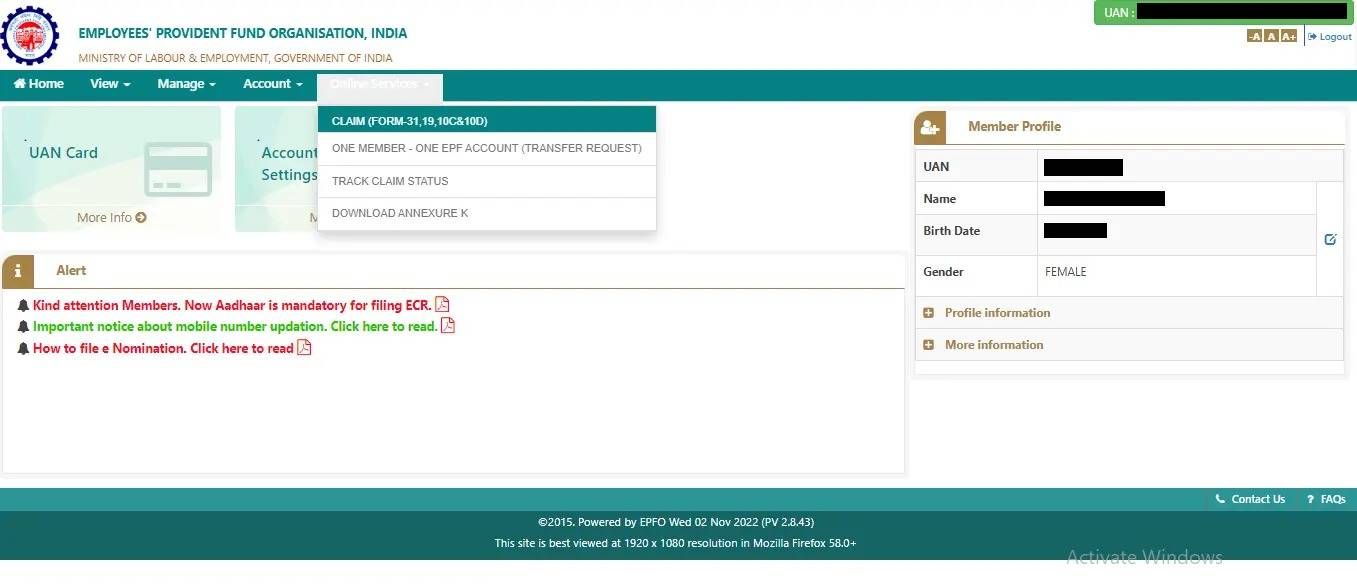

Health is a fundamental aspect of everyone's life, and during emergencies, quick access to funds is crucial. In such situations, PF account holders can withdraw funds by submitting Form 31 along with a medical certificate signed by both the doctor and the account holder. Up to ₹100,000 can be withdrawn for medical treatment in a single instance.

Home Purchase:

Often, individuals require funds to purchase a house. In such cases, one can withdraw money from their PF account for this purpose. However, an important condition is that the PF account must be at least three years old. For a home purchase, up to 90% of the total amount can be withdrawn. It's important to note that this facility can only be availed once.

Home Renovation:

Apart from buying a new home or land, PF funds can also be utilized for renovating an existing property. To be eligible, the account holder must have contributed to the PF account for at least five years. For renovations, one can withdraw up to 12 times their monthly salary from the PF fund. Similar to home purchase, this facility can only be utilized twice.

Home Loan Repayment:

If an individual has taken a home loan and is facing difficulty in repaying the equated monthly installments (EMIs), they can utilize their PF account for loan repayment. For this, a minimum contribution of three years to the PF account is required. Up to 90% of the PF fund can be withdrawn for this purpose.

Wedding Expenses:

Weddings often entail significant financial commitments. To alleviate this burden, PF account holders can withdraw up to 50% of their contributions, along with interest, for their own wedding. However, the account holder must have completed at least seven years of service. Additionally, funds can also be withdrawn for the weddings of siblings.