Union Budget 2023: Increased Tax Rebate from Rs 5 Lakh to Rs 7 Lakh and New Tax Regime Announced

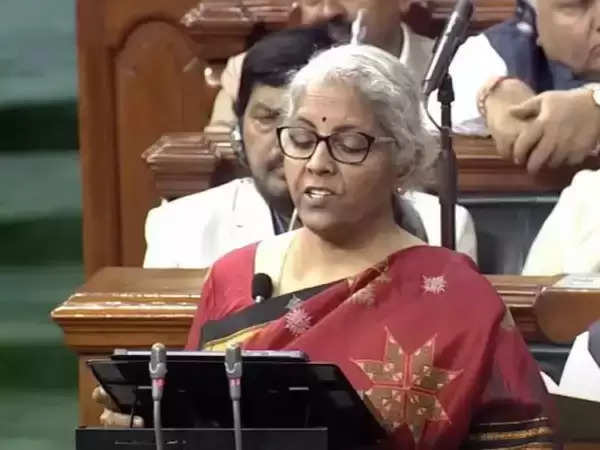

Union Budget 2023 was presented by the Narendra Modi-led government on Wednesday, and the Union Finance Minister, Nirmala Sitharaman, announced new tax slabs for the financial year 24. The announcement of a new tax regime has generated much excitement among the salaried class, who have been eagerly waiting for an update on the income tax rebate.

The current income slab and tax rates under the regular tax regime have remained unchanged since the financial year 2017-18. As such, the salaried class was looking forward to changes in the income tax rebate. However, the FM did not announce any changes to the income tax slabs in the last Budget. Despite this, the salaried class was still excited about the announcement of a new tax regime, as it held the potential for an increase in the income tax rebate.

In the new tax regime, the tax rebate has been increased from Rs 5 lakh to Rs 7 lakh. This increase will provide a much-needed relief to the salaried class, who have been struggling with rising costs of living. The Finance Minister, Nirmala Sitharaman, defended the new income tax regime last month, saying that it had not reversed any gains from the old regime’s simplicity. She added that the new regime aimed to avoid harassment and remove it by bringing in faceless tax assessment.

In the 2020-21 Budget, the government introduced an optional income tax regime, under which individuals and Hindu Undivided Families were to be taxed at lower rates if they did not avail specified exemptions and deductions. Under this regime, total income up to Rs 2.5 lakh was tax exempt. A 5 per cent tax was levied on total income between Rs 2.5 lakh and Rs 5 lakh, 10 per cent was levied on Rs 5 lakh to Rs 7.5 lakh, 15 per cent on Rs 7.5 lakh to Rs 10 lakh, 20 per cent on Rs 10 lakh to Rs 12.5 lakh, 25 per cent on Rs 12.5 lakh to Rs 15 lakh, and 30 per cent on income above Rs 15 lakh.

In comparison, under the old system, income up to Rs 2.5 lakh was exempt from personal income tax. A 5 per cent tax was levied on income between Rs 2.5 lakh and Rs 5 lakh, while 20 per cent tax was levied for income between Rs 5 lakh and Rs 10 lakh. Income above Rs 10 lakh was taxed at 30 per cent.

In conclusion, the new tax regime announced in the Union Budget 2023 has generated much excitement among the salaried class, with the increase in the income tax rebate from Rs 5 lakh to Rs 7 lakh providing a much-needed relief to the struggling class. The new regime, along with the optional income tax regime introduced in the 2020-21 Budget, aim to provide tax relief and remove harassment faced by taxpayers, while still retaining the gains of simplicity from the old regime.