Gold and Silver Prices Dip on New Year's Day 2026

Market Overview on January 1, 2026

As the new year 2026 begins, the bullion market is experiencing a slight downturn. On the morning of January 1, 2026, gold and silver prices saw a minor decline. However, throughout 2025, gold provided investors with an impressive return of approximately 73.45%. The demand for gold remained strong due to global uncertainties, central bank purchases, and its role as a hedge against inflation. In contrast, silver prices have also dropped today following a significant surge.

Current Gold Rates: On the first day of the new year, gold prices have decreased. In the capital city of Delhi, the price of 24-carat gold has fallen to ₹135,030 per 10 grams. In Mumbai, the rate stands at ₹134,880 per 10 grams. The international market price for gold is currently at $4,308.30 per ounce. Both domestic and global factors influence the prices of gold and silver within the country. Let’s take a look at the gold rates in some major cities.

Today's Prices (January 1, 2026):

- Gold (24 Carat, 10 grams): ₹1,34,880 – ₹1,35,220 (slight variations across cities, down by ₹600-₹700 from yesterday)

- Gold (22 Carat, 10 grams): ₹1,23,790 – ₹1,23,950

- Silver (per kilogram): ₹2,38,900 – ₹2,39,000 (showing slight softness compared to yesterday)

City-wise Rates (Approximate):

- Delhi: 24K – ₹1,35,030 / 10g

- Mumbai: 24K – ₹1,34,880 / 10g

- Hyderabad/Bengaluru: 24K – ₹1,34,880 – ₹1,35,060 / 10g

Reasons for Price Increases Last Year

The prices of gold and silver in the country are influenced by both domestic and global factors:

- Global: Geopolitical tensions, cuts in the US Fed rates, dollar weakness, and record purchases by central banks.

- Domestic: Weakness of the rupee, demand during festivals and weddings, and the popularity of gold as an investment.

- In 2025, MCX gold saw a surge of up to 81%, while the international market recorded a 72.7% increase.

Experts believe that gold will continue to be a safe investment in 2026, although short-term fluctuations are possible. There is also an expectation of growth in silver due to industrial demand (solar, EV, etc.).

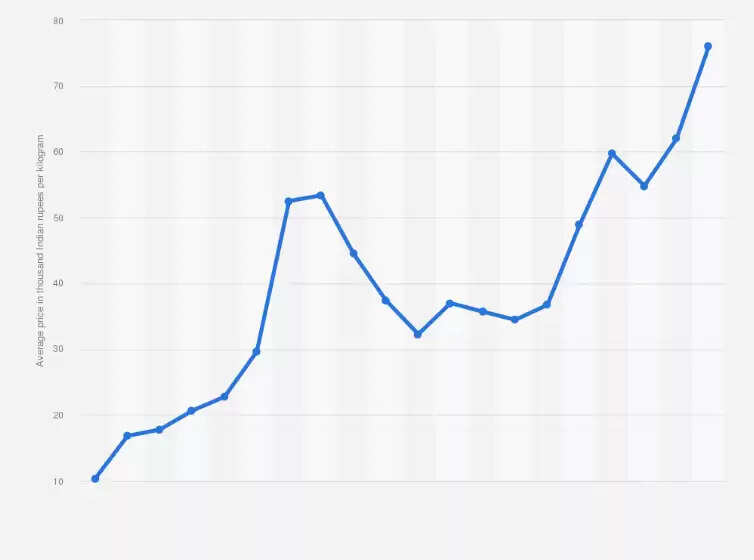

Visual Insights